An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it. Who are the experts.

What Is The Difference Between Direct And Indirect Tax Quora

Examples of indirect taxes include landfill tax fuel duties import duties and tobacco duties.

. Direct tax is levied and paid for. If tax is levied on the goods or services of a person is collected from the buyers by another. Income Tax Wealth Tax etc.

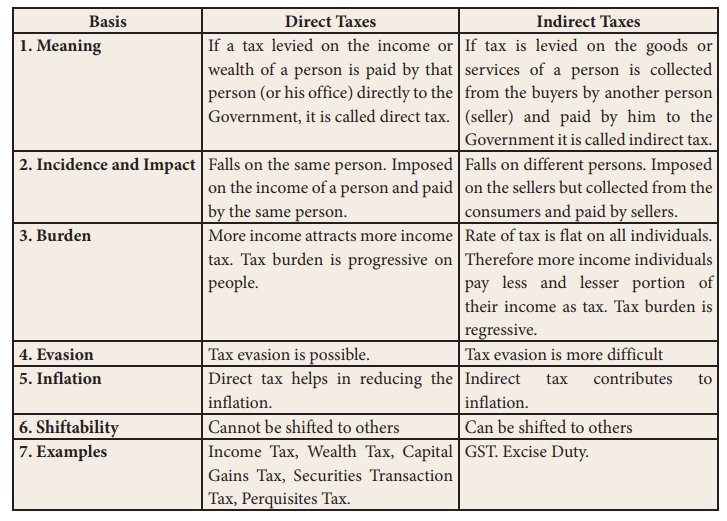

The difference between a direct tax is one that must be paid directly to the government by the person on whom it is imposed and indirect tax is one. The main differences between direct taxes and indirect taxes are given in table. These are defined according to the ability of the end taxpayer to shift the burden of taxes to someone else.

Must be paid directly to the government by the person on whom it is imposed Indirect. An indirect tax is one that can be passed on-or shifted-to another person or. Give examples of each.

Indirect taxes on the other can be felt by everyone who buys goods and avails services. 12 rows In the case of direct taxes tax evasion is possible whereas in the case of indirect. If a tax levied on the income or wealth of a person is paid by that person or his office directly to the Government it is called direct tax.

Sales taxes can be direct or indirect. A direct tax is one that the taxpayer pays directly to the government. Moreover the indirect tax is the final tax is payable by the end consumer of goods or services.

It is imposed on all goods and services. Taxes are classified as direct indirect taxes. One of the major difference between direct and indirect tax is that direct tax is progressive while the indirect tax is retrogressive.

Amount of taxation depends on income and profits generated by individual Tax imposed is to be same for all category of people 4. This means that direct tax increases with the amount that is available for taxation while indirect tax reduces the. Taxes can be either direct or indirect.

While direct taxes are imposed on income and profits indirect taxes are levied on goods and services. Direct taxes allow the government to collect taxes directly from the consumers while indirect taxes allow the government to expect stable and assured returns through the society. Taxes can be either direct or indirect.

Give examples of when a government might engage. The example of a direct tax would be income tax which is also called a progressive kind of tax. If they are imposed only on the final supply to a.

Experts are tested by Chegg as specialists in their subject area. The tax that is realized directly from the individual upon whom it is levied is called a direct tax while the taxes that are collected from intermediaries rather than those who actually pay them are called indirect taxes. Direct taxes are imposed only on people that belong to various income brackets.

Briefly explain the difference between a direct tax and an indirect tax. These taxes cannot be shifted to any other person or group. A A direct tax is paid by a person on whom it is legally imposed.

The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who then pays it to the government. The difference therefore between direct and indirect taxes is that in the case of direct taxes the individual pays the tax directly to the government but when it comes to indirect taxes the individual pays the tax to someone else who. B Sales tax excise duty service tax are examples of indirect tax.

This reduces the cascading effect of tax. Indirect taxes apply to certain services purchasing or importing products. Explain the difference between a direct tax and an indirect tax.

If they are imposed only on the final supply to a consumer they are direct. It is to be paid by Individuals and businesses organizations. Direct Taxes Vs Indirect Taxes.

In simple terms direct taxes are payable by the individual or the company that is earning the profit. We review their content and use your feedback to keep the quality high. Direct taxes lessen the savings of earners but indirect taxes encourage the opposite because they make products and services more expensive and unaffordable.

Service tax is charged at the pace of 15 as of nowThe taxability arises once the. Use an example to illustrate the difference. A direct tax is one that the taxpayer pays directly to the government.

It cannot be transferred. Direct taxes apply to property assets and money. Direct taxes include corporate tax gift tax sin tax estate tax income tax value-added tax VAT property taxand taxes on assets.

These taxes cannot be shifted to any other person or group. Explain the concept of deficit financing deficit spending. Paid first by one person but then passed onto another.

A major difference between direct and indirect tax is the fact that while direct tax is directly paid to the government there is generally an intermediary for collecting indirect taxes from the end-consumer. A Indirect tax is imposed on one person but paid by the other. How much indirect tax do we pay.

Since the indirect tax is applicable to every stage of the production-distribution chain the credit of the tax is allowed to be taken. 6 rows Key differences between Direct and Indirect Tax are. It is to be paid by End-consumers.

1 It is imposed on income and profits.

What Is The Difference Between Direct And Indirect Tax Quora

Differences Between Direct Taxes And Indirect Taxes

Difference Between Direct And Indirect Taxes Introduction To Indire

0 Comments